Thanks to the collaboration between Studia.Bo and Acimga, which provides associated companies with a multiplicity of specialized reports for products and outlet areas, Converting offers its readers a selection of exclusive and up-to-date market data and analyses, covering the most interesting economies for export oriented companies. In this article we deal with Europe, with particular attention to the most promising markets: Germany, Holland, Poland and Turkey.

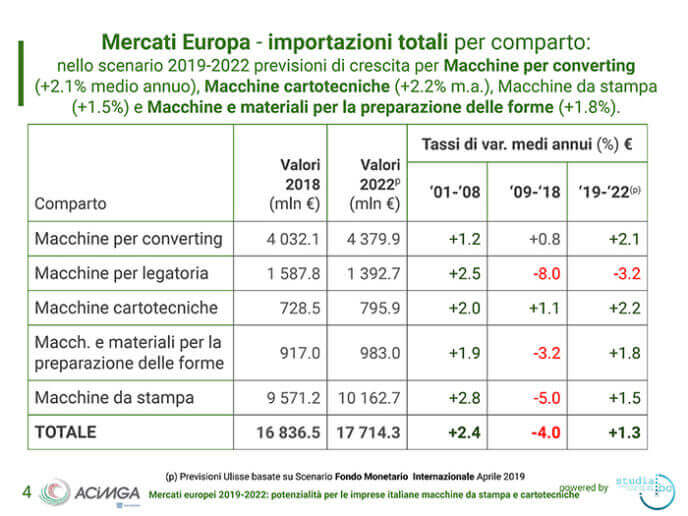

Europe is the largest end market for Italian printing and converting machine manufacturers. In fact, 68% of Italian exports go to Europe, comprising 41 countries, including Russia and Turkey. With good prospects: it is a market destined to grow over the next four years, after the decade of crisis (2009 to 2018) which saw a decline of 4 average percentage points per year. Sector imports in the Old Continent are thus switching direction, increasing by 1.3% every 12 months to reach a value of 17 billion and 714 million.

Italian exports to Europe

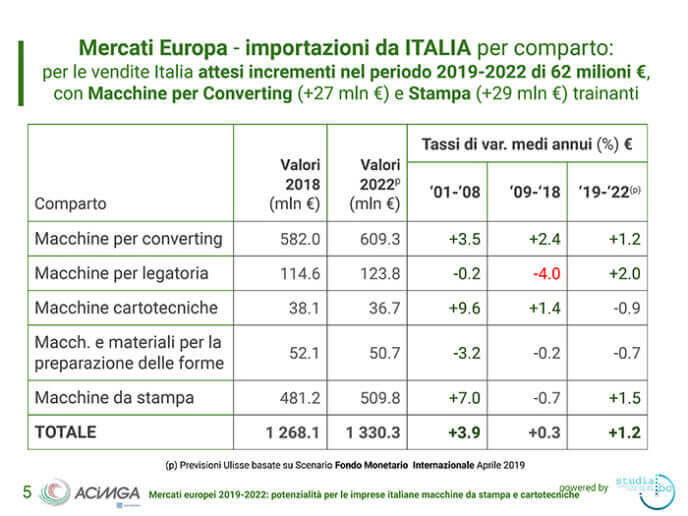

In this scenario, Italian exports to Europe will increase by over 62 million, going from 1268 to 1330 million in total, with an average growth rate of + 1.2% every twelve months (against the mere + 0.3% of the last decade). The highest growth is seen in bookbinding machines with + 2% per year (after the – 4% registered from 2009 to 2018) with an increase in the value of exports of 10 million (from 114 to almost 124 millions). The performance of printing machines is also good, with exports going from 481 million in 2018 to 510 million in 2022 (+ 1.5% per year) and converting machines up by 1.2% every twelve months (from 582 to 609 million). Both paper converting and mould preparation machines see their market shrink by 2 million, with an average annual loss of 0.9 and 0.7% respectively (in 2022 paper converting machine exports will be worth 36.7 million and mould preparation machine exports 50.7 million).

The most receptive countries

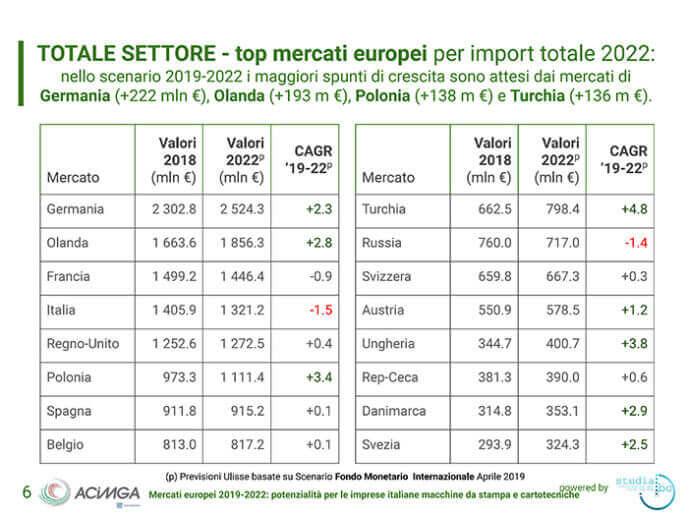

The countries that will import more are Germany, Holland and France. While, however, the latter will see a contraction of the market (-0.9% per year), Germany will exceed the 2 and a half billion imports (177 million of which by Italian suppliers) with an average annual growth of 2.3%, Holland putting in as much as 2.8% (from 1663 to 1856 million in value).

Poland and Turkey will also be putting in an interesting performance. The former going from 973 million of goods imported in 2018 to 1 billion and 111 million in 2022 (+ 3.4% per year) and Turkey from 662 to 798 million (+4.8 per year). These trends are mainly generated by printing, converting and papermaking machines.

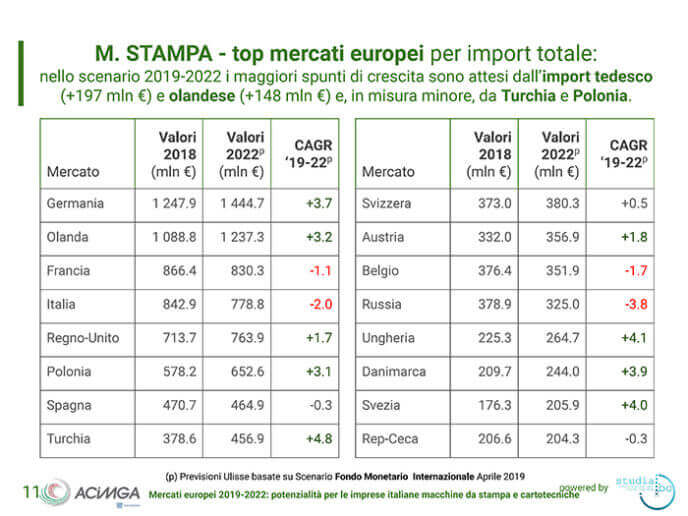

Printing presses In this prime segment, good growth performance is expected for German imports, which in 2022 will increase by almost 200 million, from 1247 million in 2018 to 1445 (+ 3.7% per year). The value of printing presses in the Netherlands will grow by around 150 million, with an import of goods of 1237 million (+ 3.2%). Turkey and Poland, while seeing a drop in the increase in value of imports in absolute terms (respectively 78 and 74 million) will register an average + 4.8% and a + 3.1% percentage increase every 12 months.

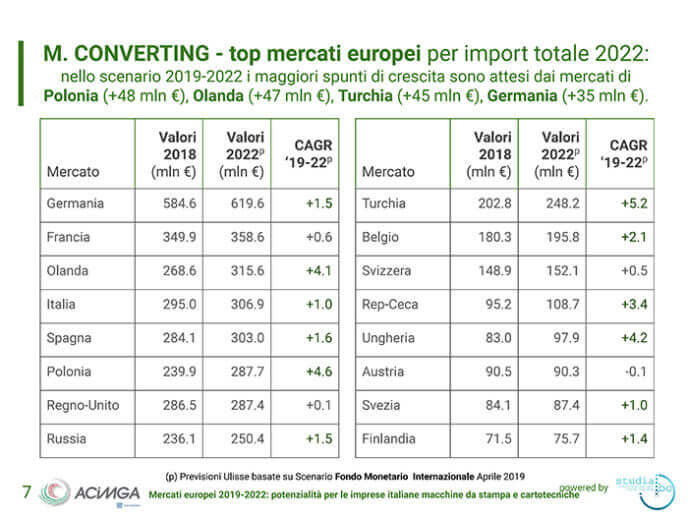

Converting and papermaking As for converting machines, the markets in Poland (+ 48 mln euros), Holland (+ 47 mln), Turkey (+ 45 mln) and Germany (+ 35 mln) Poland will grow the most in absolute terms. The value of paper converting machine imports in 2022 will grow by 15 million in the Netherlands, by 14 in Poland and by 8 in Turkey and Germany. The latter remains the only European market to import goods worth more than 100 million a year (109 in 2022).

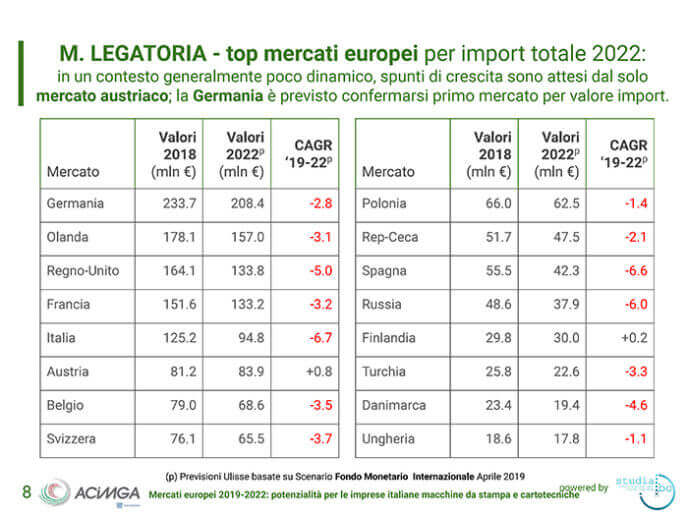

Bookbinding Bookbinding machines, on the other hand, are in decline throughout Europe with the sole exceptions of Austria (+ 0.8% growth per year) and an even lower growth in Finland (just 0.2% more each twelve months). In 2022 the German market will be worth 25 million less, but with its 208 million imports it will firmly maintain its position as the largest importer on the continent.

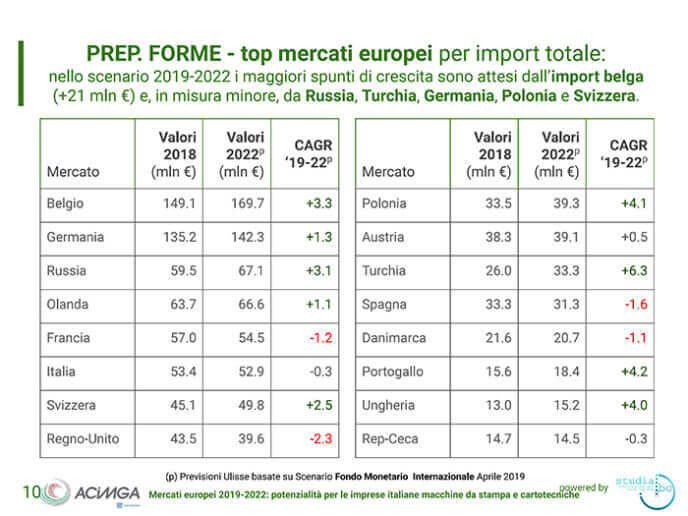

Pre-press Belgium is instead on the highest step of the podium for the import of mould preparation machines. With an average annual growth rate of 3.3% in 2022, it will import around 170 million of goods. Following them, Germany will grow by 1.3% every 12 months for a total of 142 million in 2022. The third largest market, though with a value of around 50% lower than the German one, Russia, will grow by 3.1% a year and in 2022 is scheduled to import mould preparation machines for 67 million euros.